The proportion of trading businesses reports a drop from 26% in January 2024 to 22% in February 2024. Meanwhile, 55% of businesses reported static business turnover during the period. 18% of companies believe low customer demand is the prime reason behind business slowdown. Other reasons like rising energy costs and costly manufacturing materials also impact business growth.

Amid this, constant research is critical to “grow your small business” quickly”. The eagerness to scale with the affordable funding option remains the prime aspect.

Stubbornly high inflation rates in 2023 proved challenging for businesses. Thus, getting quick and cheap funding options proved challenging. The year reveals slow growth despite a drop in inflation and interest rates. However, despite difficulties, 80% of business owners are hopeful about bright prospects. 51% believe in increasing profit percentage by 10% or more.

Additionally, the statement by Andrew Bailey, Bank of England governor, fumes hope.

“Recession may already be over with economy revealing distinct signs of an upturn.”

Which business industry are growing well in 2024 in the UK?

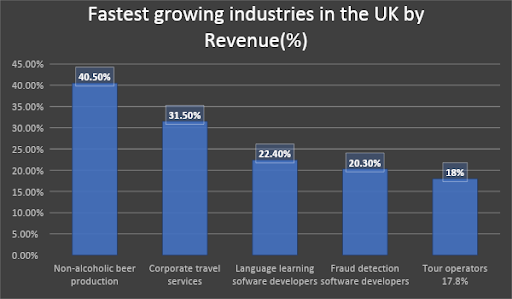

The data by IBISWorld reveals a list of the fastest-growing industries (by % revenue growth) after surveying 440+ UK industries.

As the chart reveals the production of non-alcoholic beer is the most popular business industry in the UK country in 2024. It is believed to compound at 30% reaching £807.6 million in 2024. Per capita income, health consciousness and income drive the customer preferences.

If your business deals in any of these industries, it’s high time to grow. However, entrepreneurs face strict challenges while scaling.

What primary challenges do you face to grow your small business?

According to Startups.co.uk facts,

“24% of individuals believe economic instability is the primary factor that impacts business growth.”

Here are other key challenges for UK SMEs in 2024:

Getting quick finance or funding is the most challenging aspect.

According to RSM.co.uk stats,

“Only 33% of businesses can access the funding easily in the UK”.

Additionally, 52% of businesses wish to seek funding within 6-12 months. It reveals business plans to grow business regardless of interest rates and other factors.

How can you grow your business with the best funding options?

A business loan is the most popular way to finance your business needs. According to BritishBusinessBank, “the use of external finance by small business rose in 2023 from 41% in Q1 to business loan is one of the easiest ways to fund your requirements. Other aspects may help grow your small business swiftly in 2024.

- Business loans

As mentioned above, business loans are one of the easiest ways to secure quick finance. You may get up to £25000-£2m as secured and unsecured business loans. One uses it exclusively for business purposes. You can consider secured business loans to finance a flexible amount needed when pledging an asset.

You can use a business loan for inventory updates, streamlining working capital, Hiring, and business expansion. According to a source,

“You need at least £22,000 to fund the business’s operations in the first year.”

The figure breaks into the business needs like:

| Average amount you need for business operations and cost split | £22,518 |

| Legal fees | £7500 |

| Account management | £4500 |

| HR management | £5000 |

| Company formation | £5518 |

- Guarantor loans

Based on a survey-

“34% of business owners struggle to make a difficult choice of operating as a guarantor on a business loan”.

However, it is still the best way to secure quick and high-amount finance.

Guarantor loans require the business owner to provide a guarantee to secure funding. It can be a family, friend, business partner, Director, or company stakeholder. According to a fact- “businesses in the Finance and Accounting sectors take a loan against personal guarantees the most.”

It is the best option for businesses operating with a poor credit history.

The qualification largely depends on the business’s affordability. The lenders conduct basic checks to analyse the borrowing potential. Thus, you may know the loan approval chances with guarantor loans with no credit check facility.

The no credit check facility means- the credit assessment does not get recorded. Instead, it helps a business understand- approx., APR, interest costs, loan repayments, and total loan costs according to your chosen loan term. It works like a pre-qualification process that helps you know affordability and compare the best options.

Benefits of choosing a guarantor loan for business

The primary benefits of choosing a guarantor loan for your business needs are:

- Working capital loans

Working capital includes any business asset in liquid or tangible form. It includes aspects like-

You can calculate working capital by this formula

WORKING CAPITAL = CURRENT ASSETS-CURRENT LIABILITIES

You may secure working capital loans by revealing your affordability. You may qualify if:

- You have an operating history of over 6 months or a year

- You are an LLP or a limited company

- Your business is in the UK

- You have a minimum monthly turnover of £5000

You may get a working capital loan of up to £25000 for needs if you meet the criteria.

- Growth Capital Loans

If you want to grow your small business by boosting the bottom line, growth capital loans may help. Capital is an important aspect of consistent business growth. Limited cash reserve, depleting one or negligible one impacts operations.

Startups and small businesses in the UK marketplace struggle with sustaining sound capital. Around 38% of startups fail due to a capital shortage in the first year of business operations. Thus, it is ideal to find experts who can help boost business revenue and growth.

Growth capital loans help you fund needs like-

- Equipment purchase

- Investing in technology and software

- Paid and organic marketing efforts

- Paying existing and other debts

- Revise the business turnover

- Angel investors

Angel investors are knowledgeable and experienced individuals who invest in a business in return for an equity percentage. A startup may benefit from investments and careful guidance at every step.

According to UK Business Angels Association (UKBAA)

“Angel investors invest between £5000-£5,00,000 in a company for a 15-30% return on equity. Eventually, they expect a 10-30% return on investment within 10 years.”

Additionally, if you choose an angel investor belonging to the Seed Enterprise Investment Scheme (SEIS), you can claim tax relief. The maximum amount you can claim as tax relief is £100000.

You can spot angel investors working with the SEIS on platforms like LinkedIn.

- Contact brokers for business finance

According to a fact,

“70% of businesses facing constant rejection contact a professional business finance broker”.

Additionally, with increased business loan interest rates (6% as of January 2024), choosing the right loan is essential.

Business loan brokers help a startup or small business secure funds quickly. They do so by:

Thus, hiring an experienced business finance broker helps you save time, fetch the most affordable deal and avoid confusion. Facilities like 1:1 interaction, flexibility to adapt to changing business situations and the latest technologies quicken the loan approval process. Additionally, the brokers charge a commission fee for their services. It is separate from the repayments that one pays to a direct lender for their services.

Bottom line

These are some most of the flexible and best funding options for small business owners. If you want to grow your small business with quick funding”- these may help. The most comfortable of these is contacting a business loan broker for all your business finance requirements. You may get it quickly with professional assistance.

Gary Weaver is a Senior Content Writer with having an experience of more than 8 years. He has the expertise in covering various aspects of business market in the UK, especially of the lending firms. As being the senior member, he contributes a lot while working at TheBusinessFunds, a reputed business loan broker.

Gary performs the major role of guiding loan aspirants according to their financing needs and also to write research based blogs for the company’s website. Previously, he has worked with many reputed business firms and therefore, he knows every nook and cranny of business financing market of the country. Gary is a post-graduate with having a degree of Masters in English language. He has also done post-graduate diploma in Business and Finance.