Every small business needs money from its owners or banks to get started. But what happens when your company is going well, and you want to grow it bigger? Making way more to sell takes even more money for things like new stores, machines or workers.

Getting extra funds to expand is vital for little companies to become great big ones. Then, you earn profits to pay your business loan back over time.

The growth capital loans in the UK help you quickly scale up important stuff like advertising, equipment and people. With hard work and good planning, your strengthened company can achieve growth goals like opening branches or shipping globally.

| Main Reasons UK SMEs Seek Growth Capital Loans | How Many Businesses Agree to This |

| Cash Flow Management | 69% |

| Business Development | 37% |

| Addressing Short-term Funding Gaps | 36% |

| Responding to Economic Challenges | 20% |

| Opportunities for Innovation and Growth | All |

| Hiring and Talent Acquisition | 4% |

1. What Are Growth Capital Loans?

Growth capital loans help expanding small and medium businesses in the UK fund their development plans. These loans give you capital to invest in major growth like new equipment, additional staff, moving to larger premises or expanding operations.

It is not like normal business loans that cover day-to-day costs. Growth loans specifically focus on financing ambitious growth strategies.

Key differences from regular loans:

- Loan amounts from £500k up to £5 million

- Longer payback terms of 5-7 years

- Interest-only periods while growth initiatives move forward

- The basis is growth projections rather than current assets

The main purposes of growth capital loans include:

- Buying new equipment like machinery, tools or vehicles

- Opening additional locations

- Developing new products and services

- Expanding operations substantially

- Adding personnel like sales staff

You can get these loans from a bank or direct lenders. If you have more custom needs, you can contact any business finance broker to get these loans. These initiatives might be hard to fund from cash flow alone. These loans enable businesses to take their big expansion plans from concept to reality when lending options fall short.

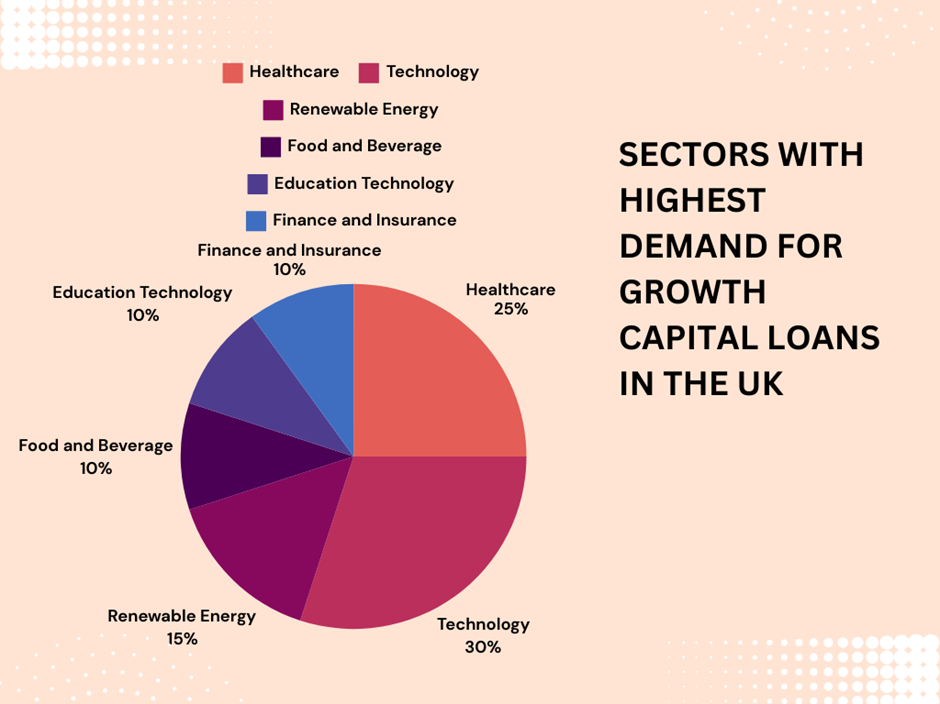

| Sector | Key Drivers of Demand |

| Healthcare | Post-pandemic focus on health services |

| Technology | Rapid innovation in software and cybersecurity |

| Renewable Energy | Shift towards sustainable energy solutions |

| Food and Beverage | Rising consumer demand for healthy options |

| Education Technology | Increased adoption of digital learning |

| Finance and Insurance | Growth of fintech innovations |

Types of Growth Capital Loans

Term Loans

Term loans offer upfront lump sums for major growth plans and equipment purchases. You repay the money over 1-5 years with fixed monthly payments. Some term loans offer flexible features like:

- Interest-only periods at the beginning

- Option to only pay interest before tapping more funds

- Ability to draw down multiple times for staged growth

These loans allow you to retain ownership and projected earnings. They often require collateral assets. These loans suit growth capital needs like opening new locations.

Revenue-Based Financing

Repayment comes from a percentage of your future revenue over several years with this financing. There is more flexibility than standard loans. Some features include:

- Payments fluctuate based on monthly sales

- No traditional underwriting requirements

- Fund use is not restricted

This type works for ambitious small companies with recurring revenue streams. Software and e-commerce businesses often use this option.

Mezzanine Financing

Mezzanine financing combines senior debt and equity structures. So, investors receive ownership rights with a flexible loan. These include:

- Higher amounts than traditional financing

- Warrants or equity participation for lenders

- Expensive due to risk levels

If you are into real estate ventures, management buyouts and market expansions, this will help.

Equity-Like Structures

Some lenders give equity-like loans so you get funding without true equity dilution or loss of control. These include:

- Royalty financing – Owe monthly royalties on revenue

- Venture debt – Warrants given to lenders

- Convertible notes – Loans convert to equity under certain conditions

| Type of Growth Capital Loan | Loan Tenure (Years) | Interest Rate (%) | Repayment Structure | Equity-like Structures | Features |

| Term Loans | 3 – 7 | 6% – 15% | Fixed monthly payments | No | Secured/Unsecured |

| Revenue-Based Financing | 3 – 5 | 15% – 25% | Repayments tied to revenue | No | Flexible repayment |

| Mezzanine Financing | 5 – 10 | 12% – 20% | Interest-only or deferred | Yes (warrants, convertible debt) | High-risk, often subordinated to senior debt |

| Equity-like Structures | N/A | N/A | N/A | Yes (shares, convertible) | Direct equity, no fixed repayment schedule |

Eligibility and Requirements

To get one of these special business loans, your company needs to show it can keep making more money over time.

- Financial History: You need solid financial records showing consistent revenue and the ability to repay debts. Annual accounts for the last 2-3 years allow assessment of historical performance. Most lenders require a turnover above £1 million.

- Growth Potential: You need a plan to grow more in the future if the bank gives you the loan. Explain how you’ll get lots more customers by making new things, selling more or hiring people. You will have to prove why that will make you lots and lots of money later.

- Business Plan: Banks also want to see you have a step-by-step plan for how every part of your business will expand. It explains how the capital enables strategic initiatives around facilities, equipment and more.

- Projections: These show how much funding you need to finance growth initiatives and hit targets. Models should show comprehensive forecasts across metrics after deploying capital.

How to Apply for Growth Capital Loans?

You’ll need financial statements, tax returns, business plans, and all the paperwork showing your company’s financial situation. This proves to lenders you can expand successfully.

You choose who you request money from wisely. Big banks want lots of future profit predictions before helping you grow. Smaller online lenders may have fewer forms to complete. So shop around for the best loan fit and rate.

Be totally upfront about your finances, both good and bad. You can ask questions if you don’t get something – these loans can be complicated. And once you apply, don’t stress too much while waiting for an answer. Approval can take some time with all the number-crunching lenders do.

A well-thought-out expansion plan makes getting one of these loans much more likely. Then, you can put the money to work, realising your growth dreams.

Example:

| One company that uses this type of business financing is Accountancy Cloud. They operate in the technology sector, selling accounting software services through the cloud. Accountancy Cloud secured a growth capital loan to expand across the UK. They used the funding to hire additional finance, marketing, sales, and product development staff in cities. This influx of capital allowed Accountancy Cloud to improve what it offers customers. With more employees on board, they could roll out improved features and new applications. It also enabled them to provide services to many more clients by scaling up the business. |

Conclusion

Expanding your company takes careful planning. First, explore all smart ways to fund the next move. Big growth is needed across the UK. Loans remain the best play. You can compare more financing options to find the best match. Growth capital loans fuel lightning growth while you still steer the ship.

If your vision is solid, ask lenders to back it and show them how injecting cash now lets your business sell way more later. Then, watch your team transform that capital into real progress.

Harry Kane is a financial writer and author who has covered wide topics related to business loans and finance for the last decade. He has been working as the Chief Contributor in finding out deals on various business finance products covered by Thebusinessfunds, a reputed business loan broker firm in the UK. The primary work of Harry is to analyse the loan requirements of various businesses according to their circumstances and affordability. He directly communicates with the loan aspirants and guides them to get the right loan matching their needs. He has a vast experience in finance writing, working with many major business firms in the UK. At Thebusinessfunds, Harry also used to write well-researched blogs covering the financial problems of business loan aspirants and providing relevant solutions. He is a postgraduate with MSc. in Banking and Finance.