Address:

128 City Road, London, EC1V 2NX

Cash flow must be stable and secure to run your business despite any disturbances. It becomes more vital if your company operates in the manufacturing industry in the UK. Firms in this sector often face issues like financial emergencies, higher expenses, late payments from clients and many more. These reasons force you to look for more working capital through manufacturing loans.

These loans are the specialised business loan funding provided by various lending firms in the UK. These can manage your company’s sudden expenses; funding gaps occur due to customer’s delayed payments, increasing invoices, etc. With easy funding in your favour, you can cover unbudgeted costs without any hassle.

The loan amount and term vary among the lenders. Still, some general loan details are:

| Manufacturing loan amount | £5000 - £500,000 |

| Loan term | 12 - 84 months |

| Interest rates | Starts from 4% (subject to change) |

| Loan approval time | Within 2 business days |

You need a reliable loan provider to get loans on features that are similar to or more attractive than these. Thebusinessfunds, a specialist manufacturing business loan broker, understands all your financial struggles. Therefore, we ensure that you company will obtain necessary working capital when you require it the most.

We have helped several manufacturing companies running here. These are but not limited to:

Does your company belong to any of these industries? Do you want more working capital to grow and expand your business? Call our experts or lodge your loan query right now here.

The manufacturing industry is typically among those industries that always rely on resources. Running a company demands continuous access to working capital to buy inventory, hire skilled staff, update equipment, or sometimes locate business elsewhere.

You should have the resources to meet your financial needs and accomplish your business goals. To achieve all these, business finance for the manufacturing sector is intrinsic, as you can use the loan amount for any related purposes.

Fill the funding gap:

Customers’ demands vary according to seasonal changes. You also need to change a lot; otherwise, your customers will not be interested in your products. Sometimes, you lack proper funding, and a gap suddenly occurs. Availing of manufacturing loans will help you to narrow that gap and maintain cash flow stability.

Buy new technologically driven equipment:

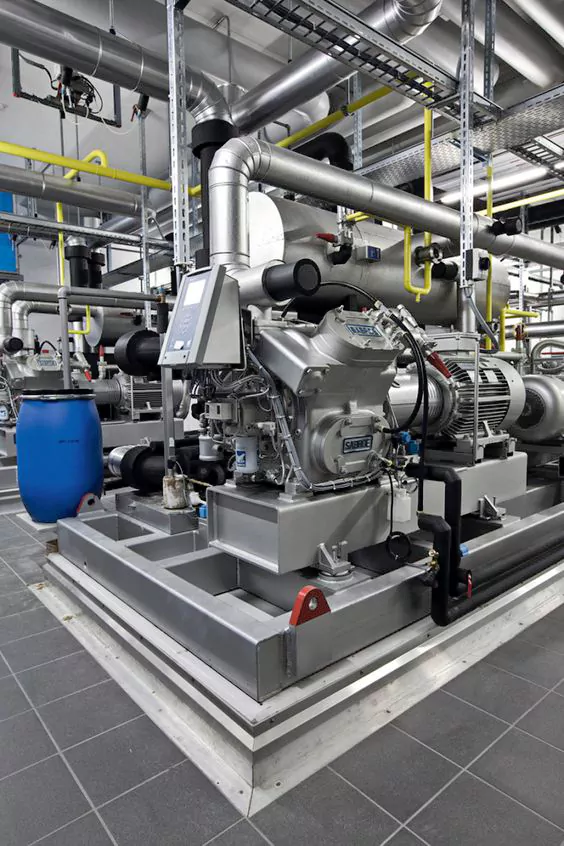

It is good that your company’s products are gaining enormous demand. Do you have the equipment to meet those demands? If not, you need to buy the new equipment that should be versed with more technology or upgrade the existing ones. You can manage its cost with manufacturing equipment loans.

Expand your business operation:

Suppose your company has gained a reputation in Manchester. Time is to expand it and attract more customers. After researching and planning, you have decided to locate another plant in Birmingham. The cost will be high as you must buy new machinery, hire more skilled staff and ensure comfortable premises. Getting approval on a loan for manufacturing plant will help you significantly increase the growth capital.

Research and development (R&D)

Researching and development for more products demand a massive funding backup. Sometimes, it is as similar as buying or placing new equipment. Yes, you have to gather the resources, hire the best researchers, and many more things, including higher expenses. You should not worry about these costs if you get a manufacturing loan approval.

Your manufacturing business has the support of a reliable commercial finance broker like the one you get from Thebusinessfunds. Indeed, you now have comfort in finding and getting the loans with little time to spend. Still, you need to be careful while moving forward for manufacturing business loans.

What should you do? Nothing extraordinary is required. Instead, follow only the basic requirements, which include:

Be sure on your actual business needs

Businesses’ financial requirements vary from each other. These largely depend upon factors like working capital, equipment or inventories. You should have a detailed business plan that indicates your business funding needs. With this, you can decide on the most appropriate loan product and the most affordable loan amount.

Qualify for your business for loans

Some manufacturing business loan lenders are specific on your business qualification. What do they usually prefer? They check the business’s credit score, financial activities, annual returns, risk involved and debts, if any. You should have an enhanced credit score to make your loan application stronger. Besides, keep proper documentation of all the required aspects. In general, you need the following documents:

Keep your paperwork ready to avoid any delay and ensure instant funding for your business purposes.

Calculate the total loan cost:

The loan experts at Thebusinessfunds always suggest only going for loans after analysing the final loan cost. You should be sure of the interest rates and other fees like prepayment or origination fees. The manufacturing business loan calculator can determine the final price according to the company's cash flow.

Duration of loan approval and fund transfer

The loan timeline for the lender’s acceptance and amount disbursement depends upon the loan provider and your chosen loan type. For instance, approval time for long-term business loans may take up to weeks or sometimes a month. The reason is clear: you need a larger amount, but the lender will have to check everything before approving it. In contrast, short-term loans for manufacturing businesses take less time to approve and disburse.

Business loans for manufacturing businesses have both advantages and disadvantages. You cannot ignore one for another, and analysing all such points should be included in your loan planning. As a reliable manufacturing business loan broker, we suggest you carefully scrutinise every aspect of the loan and ensure a better deal for your business growth.

Manufacturing loan advantages

Below are some aspects explaining how these loans benefit your manufacturing business.

You will get interest rates on the lower side if you have applied for a secured business loan. Your business asset as the loan collateral will work as the guarantee of timely repayment for the lender.

You get loans on fixed monthly payments. Since you know the instalment amount, you can better manage your budget for other business expenses and loan payments.

Manufacturing loans are available for any credit score. If you have a decent credit history, you can strengthen it further. In a lower credit profile scenario, you can improve the score by repaying the loan on time.

Manufacturing loan disadvantages

Like other business loans, these loans also have some cons for the businesses. These include:

A lender can repossess your business asset if you default on the loan. It is a considerable risk. If you want to avoid it, go for an unsecured business loan.

You should have a good credit score or may struggle if you have a poor score. If a lender approves a loan, you pay very high-interest rates.

You have applied for a no-collateral loan, or your credit score is not satisfactory. This will raise the total loan cost and increase the debt burden on your business income.

Thebusinessfunds is committed to finding the most relevant financing solution for your manufacturing business. We will explore all the options available in the marketplace and recommend the best one that fits your business needs.

Here are the manufacturing financing options to choose from as per your affordability and circumstances:

Is your manufacturing business dedicated to the construction field? Do you want to expand it by taking on more prominent projects? You can proceed with your plans, but having a proper budget is also necessary for the related expenses. Instead of rejecting those growth prospects, you can look for manufacturing business loans in the UK to fund fresh or existing construction projects.

Equipment Finance

Another type of manufacturing is equipment financing. With this business funding source, you can avail of loans for buying extensive equipment without burdening your business finances. It is a secured loan option where you use that equipment as collateral. You may lose the equipment if you do not repay the loan on time. Some lenders also offer a choice of equipment leasing.

Do you have many unpaid invoices to be cleared by your clients? Is it affecting your business's regular cash flow? If yes, then you should go for invoice financing. Here, you can use those unpaid invoices as the loan security and get the required amount at lower interest rates. Till your invoices get cleared, you can use the loan amount to stabilise the cash flow.

Selecting a lender is exceptionally vital to have the best loan deal available. Whether you need long-term funding or just a small one, you should have a lender who can understand and provide the most suitable loan option. To have that lender, you need to do a comprehensive comparison, which you can do at Thebusinessfunds.

Here are a few recommendations to follow while comparing manufacturing business loan providers in the UK:

Lenders’ record: Our loan experts suggest the lenders' names and show you their proven track records in the manufacturing industry. You should pick one who understands and is willing to offer adequate funding according to your requirements.

Analyse the loan products: Your next step is to decide which manufacturing loan type you want. You should work first on your actual business needs. For instance, you can look for asset finance if you want a larger amount and are ready to put a company's asset as loan security.

Loan rates and conditions: It is an essential step irrespective of the secured or unsecured loan you have opted for. You should have an affordable interest rate to manage well, along with the principal amount. Similarly, you need to read the entire loan terms and conditions thoroughly before signing the loan contract.

Read customers’ reviews: You need to check the lender's authenticity on which you want to show trust. You can read the online reviews or testimonials mentioned on the lender's website. Do not judge only by reading those reviews. Instead, consider the points mentioned above too.

Your ultimate goal is to find a trustworthy lender to support your company's growth. Good research will pave the way for better outcomes.

If you require funding support for your manufacturing business, consider Thebusinessfunds. We are a committed and responsible commercial finance broker, providing financial solutions to assist companies with ongoing financial challenges.

We have a vast compilation of lenders who make loan decisions only after going through your company's financial health. They make a decision which is beyond credit score barriers. Since our inception, we have supported hundreds of small or large manufacturing businesses whenever they seek funding.

There may be many destinations to find lenders, but we make sure you get only the best one of them. Our services include almost every type of industry. For instance, we support healthcare, automotive, hospitality, transportation, education, media and many more sectors.

Would you like to get more from us and get the instant capital access that your manufacturing business requires? Fill out the online application page, and soon, one of our loan experts will contact you to inform you what steps to take.